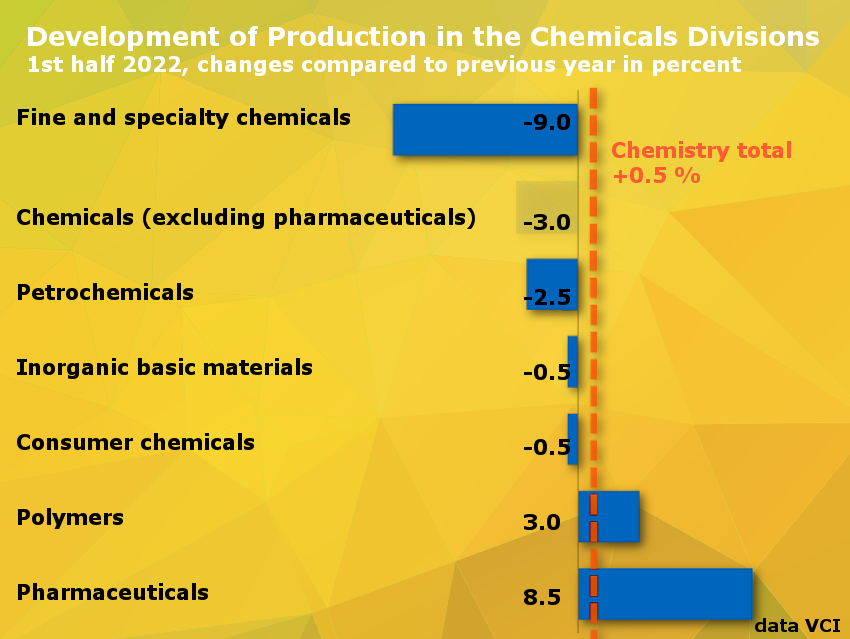

Long delivery times, high freight costs, shortages in inputs and materials, and rising prices for raw materials and energy, especially for natural gas, hampered companies in their business activities in the first half of the year. Therefore, the chemical-pharmaceutical industry expanded its production by only 0.5 %. Excluding pharmaceuticals, output fell by 3 %.

According to the German Chemical Industry Association (VCI), the increase in sales masks the real economic situation of Germany’s third-largest industry: Volume sales in the classical chemicals business are declining, order backlogs have largely been reduced, and plant capacity use has fallen to 80 %. At the same time, the profit margins are coming under increasing pressure, as the cost of raw materials and energy rose by more than a third on average from January to June compared to the previous year. For over 20 % of companies, this cost increase exceeded even 50 %.

Almost all sectors of the industry recorded production declines in the first half of 2022 (pictured). Only the polymers sector recorded a year-on-year increase of 3 % and the production of pharmaceuticals increased by 8.5 % due to the special situation of the coronavirus pandemic.

Poor Outlook

The VCI expects pressure on earnings for the German chemical and pharmaceutical industry to remain high in the second half of the year. Natural gas is expected to remain significantly more expensive than in other regions of the world. As a result, Germany as an industrial location is increasingly facing a competitive problem. For 2022 as a whole, the VCI expects production to decline by 1.5 %, assuming price-intensive but sufficient energy and raw material supplies. For the chemicals business alone, the VCI anticipates a 4 % decline in volumes. However, much will depend on the course set by the industrial policy in the coming months.

In exchanges with the German government and the Federal Network Agency (Bundesnetzagentur), the industry is preparing for various scenarios of reduced gas supplies from Russia. The talks are constructive and the German government’s commitment to allow coal-fired power plants that have already been shut down to go back onto the grid is welcomed as a measure to temporarily deal with the gas shortage.

Slow Licensing Procedures and Logistics Problems in Rail Transport

According to analyses by Ernst & Young, the number of foreign investment projects in Germany has declined noticeably since 2017. This is mainly due to high energy costs, enormous bureaucratic hurdles, and lengthy approval procedures. In mid-February, the VCI presented a concept for shortening planning and approval procedures throughout Germany without compromising due diligence and safety. Every year, around 1,500 procedures for industrial plants are carried out in Germany based on the Federal Immission Control Act. Currently, such procedures with environmental impact assessment and public participation usually take five to eight years before approval is granted.

Rail transport, which is important for the transportation of raw materials and goods, is currently under extreme strain. The VCI warns of a further worsening of the situation due to upcoming construction activities, which are intended to shift 20 % of transport from rail to truck, although traffic density is also high on the road and there is a shortage of truck drivers. Instead, the VCI demands that the construction work on parallel lines should be staggered and that DB Cargo should optimize its dialog with the industry as a customer group.

Prioritization of the EU’s Political Agenda

In the view of the VCI, the balance between the environmental and climate agenda and maintaining international competitiveness must be readjusted. At the EU level, there are currently around 150 regulations in the pipeline or in the draft stage, often with a multi-billion impact on the industry.

There should be a clear prioritization of those legislative projects that Europe needs now, as it is no longer possible for either Member States or industry to constructively cope with this wave of regulations. Furthermore, it would be desirable to promote initiatives for global climate protection instead of isolating Europe. The future belongs to those who win partners for their ideas.

- Verband der Chemischen Industry e.V. (VCI; German Chemical Industry Association), Frankfurt, Germany

Also of Interest

Interview: Chemical Industry Creates Platform to Achieve Ambitious Climate Targets

Interview: Chemical Industry Creates Platform to Achieve Ambitious Climate Targets

July 6, 2021

Interview with Jenna Juliane Schulte and Manfred Ritz of the German Chemical Industry Association (VCI)