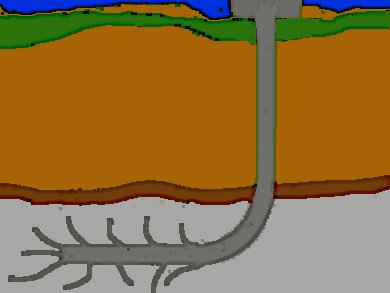

The U.S. advantage of the boom in shale gas is already showing up in earnings. The chemical unit of BASF, Ludwigshafen, Germany, saw operating profit decline 35 % in the second quarter, weighed down by input costs. Dow, Midland, USA, paid about $1 billion less for its feedstock and energy costs in the period, according to a company presentation.

Shale gas and investments on the U.S. Gulf Coast are said to have the potential to drive earnings up by about $2 billion a year in 2017.

Dow this year approved a new ethylene cracker project fueled by local ethane. Chevron Phillips Chemical Co. is spending $5 billion on a new ethylene plant in Texas, USA, and two polyethylene plastic plants. BASF is adding a 10th furnace to its Port Arthur, Texas, cracker and a formic acid plant in Geismar, Louisiana, USA.

- BASF Mothership Under Siege as Shale Forces Bock to Fight,

Sheenagh Matthews,

Business week, September 14, 2012.